Price action analysis is a trading methodology that involves analyzing the price movement of a financial instrument, such as a stock, currency pair, or commodity, to make trading decisions. It relies on the observation of price charts and the interpretation of price patterns, trends, and support and resistance levels.

Price action traders believe that all the necessary information about a market is reflected in its price movement, and that by focusing solely on price, they can avoid the noise and confusion caused by other indicators and trading strategies.

Some common techniques used in price action analysis include chart patterns such as triangles, head and shoulders, and double tops and bottoms, trend lines, candlestick charts, and moving averages. Price action traders also pay attention to key levels of support and resistance, as these levels can indicate where buying or selling pressure may be concentrated.

Overall, price action analysis is a popular approach among traders who value simplicity, clarity, and flexibility in their trading strategies.

What are the types of price action analysis?

There are several types of price action analysis that traders use to analyze market movements and make trading decisions. Here are some of the most common types:

- Candlestick chart analysis: This involves analyzing the patterns formed by candlesticks on a price chart. Candlesticks provide information on price movements, including the opening price, closing price, high price, and low price, and can help traders identify potential trends and patterns.

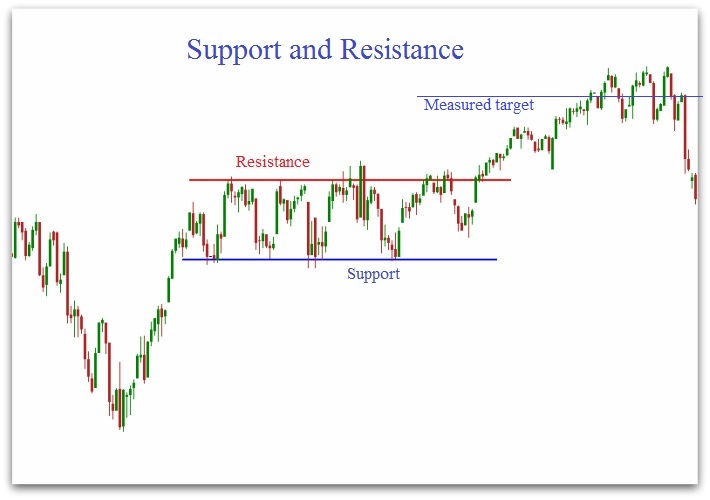

- Support and resistance analysis: This involves identifying key levels of support and resistance on a price chart, which represent areas where buyers and sellers have previously entered or exited the market. Traders can use these levels to make trading decisions, such as setting stop-loss orders or placing trades at key levels.

- Trendline analysis: This involves drawing trendlines on a price chart to identify trends in the market. Trendlines can help traders identify potential trading opportunities, such as buying when the price is in an uptrend or selling when the price is in a downtrend.

- Breakout analysis: This involves looking for patterns where the price breaks through a key level of support or resistance. Traders can use breakouts to identify potential trading opportunities and set stop-loss orders to limit their risk.

- Price pattern analysis: This involves analyzing patterns such as head and shoulders, double tops, and triangles, to identify potential trading opportunities. Traders can use these patterns to enter trades with a higher probability of success.

These are just a few examples of the types of price action analysis that traders use. Ultimately, the key is to use a combination of different techniques to gain a more complete understanding of the market and make more informed trading decisions

Open an Account Forex Broker Join Now

Open an Account Crypto Broker Join Now